Transforming Global

Trade Finance

Redesigning Import Letter of Credit processing from a legacy desktop application into a modern, guided stepper workflow—reducing cognitive load and increasing straight-through processing for global banks.

Project

Trade Innovation NEXT

Role

UX Architect

Focus Module

Import Letter of Credit

Methodology

Design Thinking

Understanding the Friction

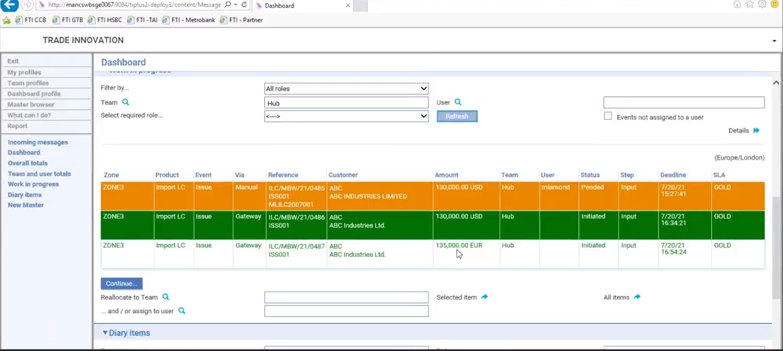

To solve the problem, I first had to audit the existing landscape. Trade Finance Officers work under strict SWIFT cut-off times, yet the legacy application forced them to work in a high-stress environment with fragmented data and no clear hierarchy.

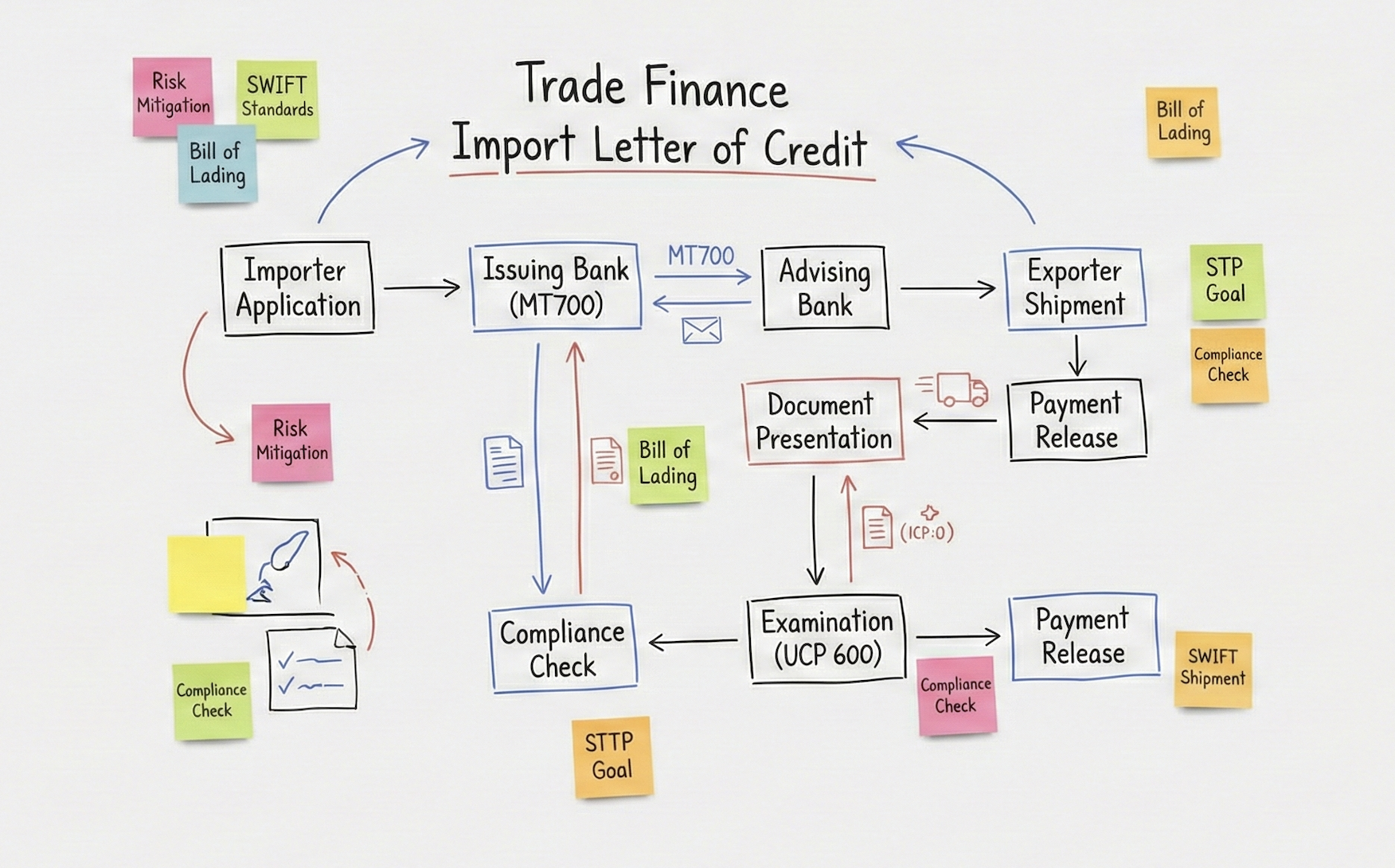

Understanding Trade Finance

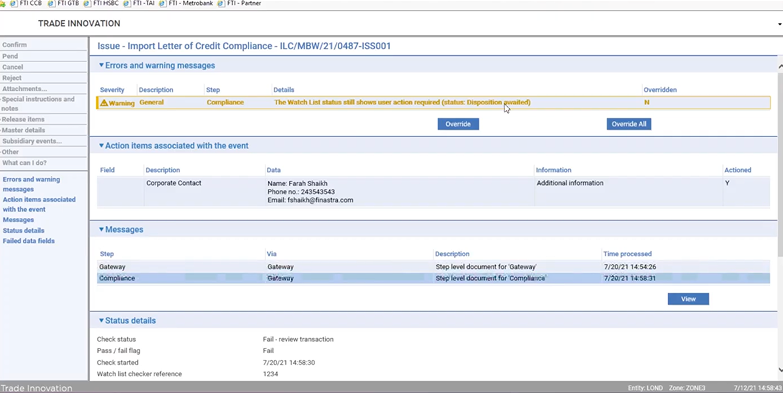

The Legacy Audit:

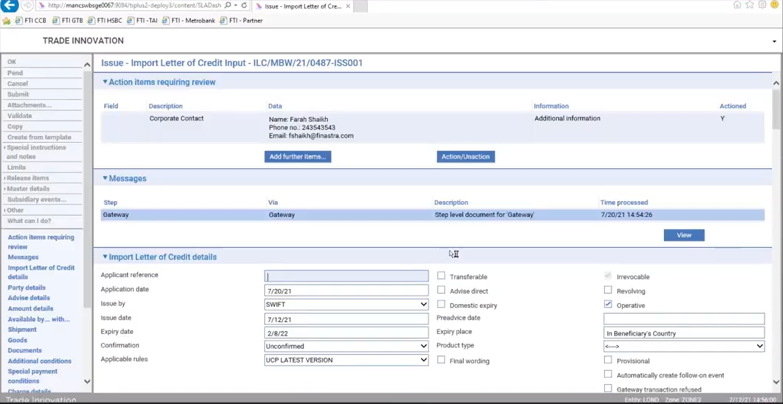

Cognitive Overload

The existing "Input" screen displayed 100+ mixed fields (Shipment, Bank Clauses, Compliance) in a single view, making it impossible to prioritize information.

Hidden Risks

Critical errors were often buried in sub-tabs, leading to high rejection rates.

The Core Problem

Problem Statement

Users are overwhelmed by the complexity of Import LC issuance. The "Single Page Dump" pattern leads to decision fatigue, manual data entry errors, and slow processing times.

The Goal

Transform the monolithic input process into a guided, error-proof workflow that reduces cognitive load and increases Straight-Through Processing (STP).

Strategic Architecture

My strategy focused on two key UX interventions to modernize the experience:

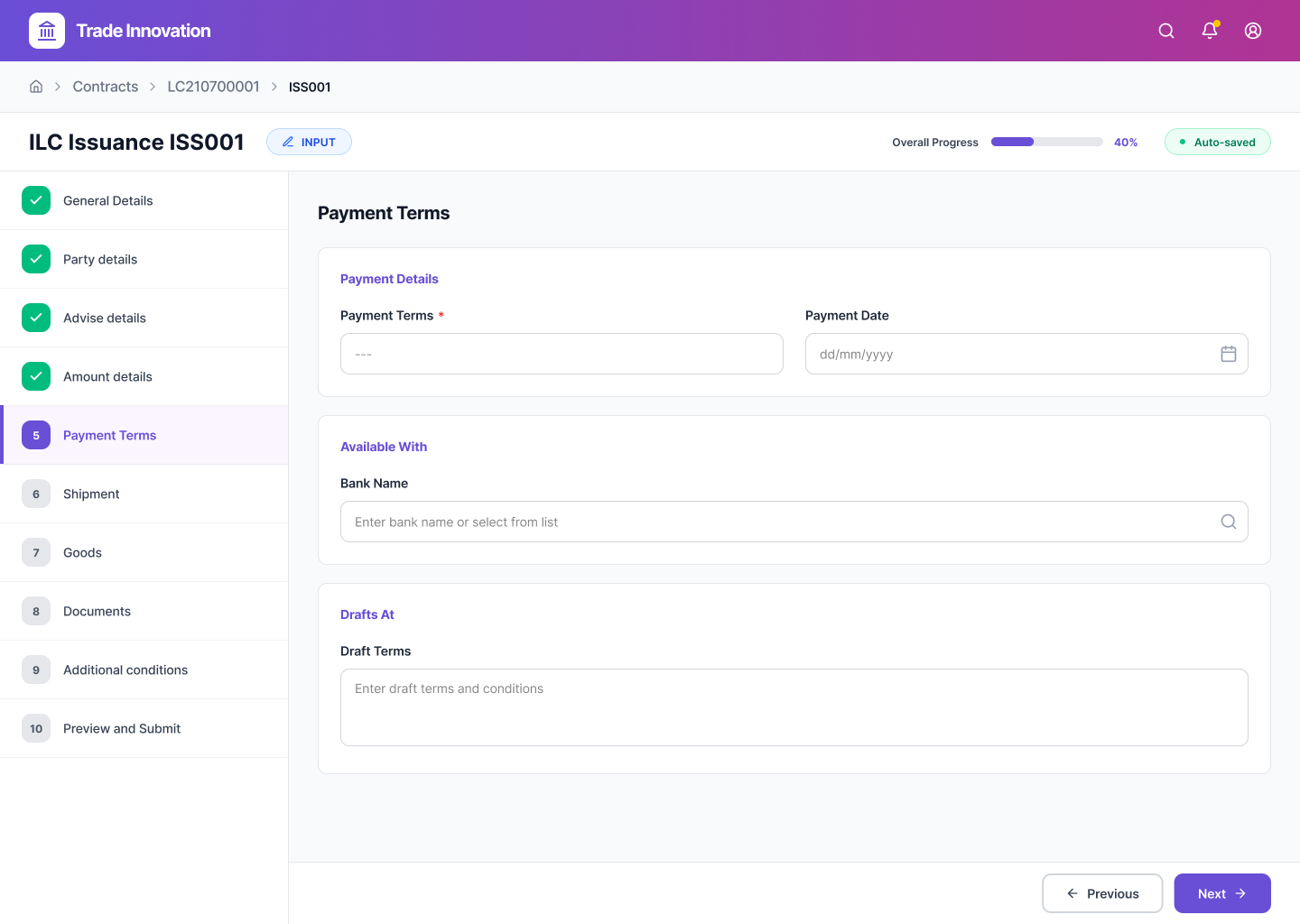

Chunking (The Stepper)

Breaking the 50+ field form into 9 distinct logical steps (e.g., separate "Shipment" from "Payment"). This ensures users focus on one context at a time.

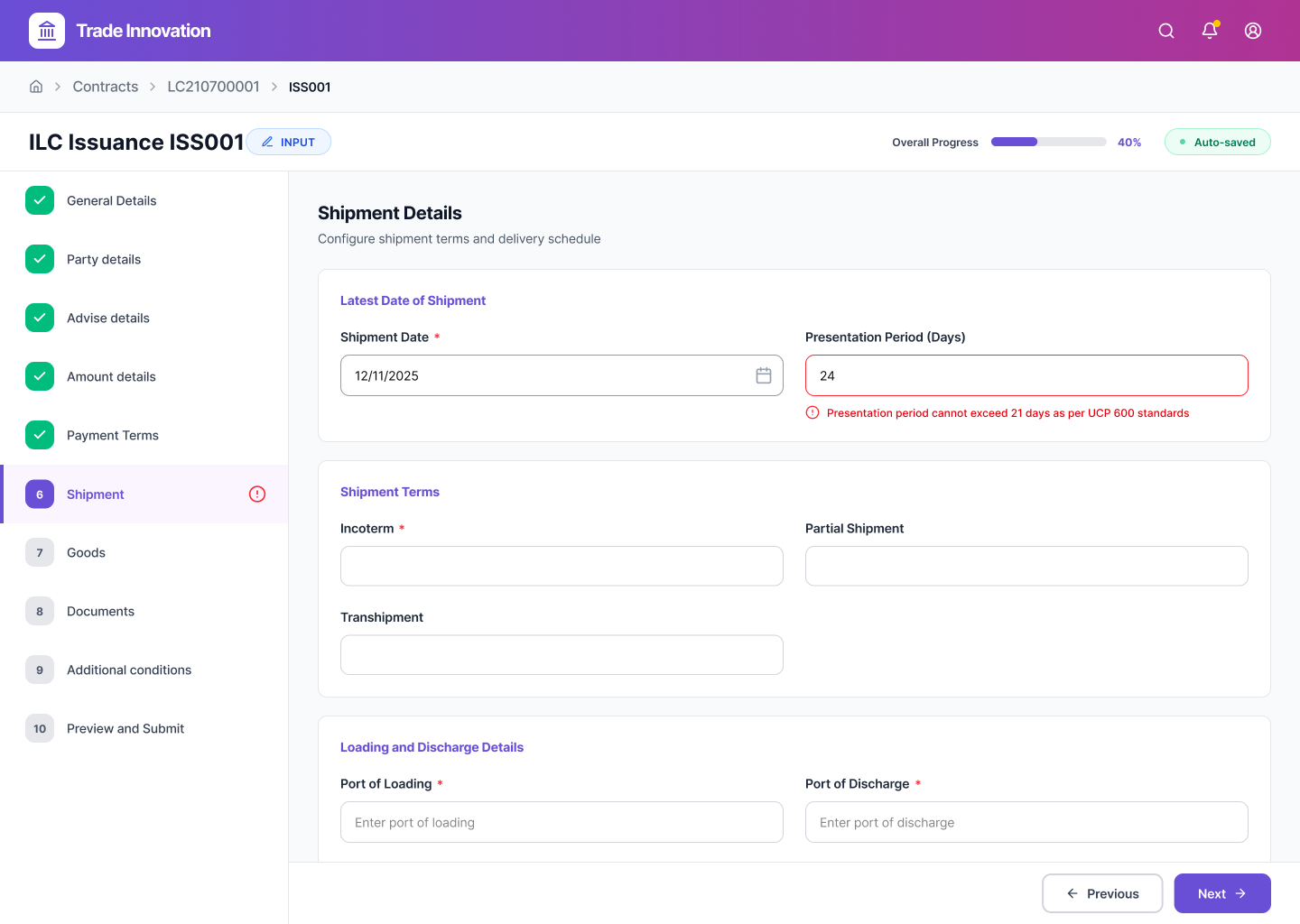

Defensive Design

Moving validation from "Post-Submission" to "Real-Time." By catching errors at the source (inline), we prevent the user from proceeding with invalid SWIFT data.

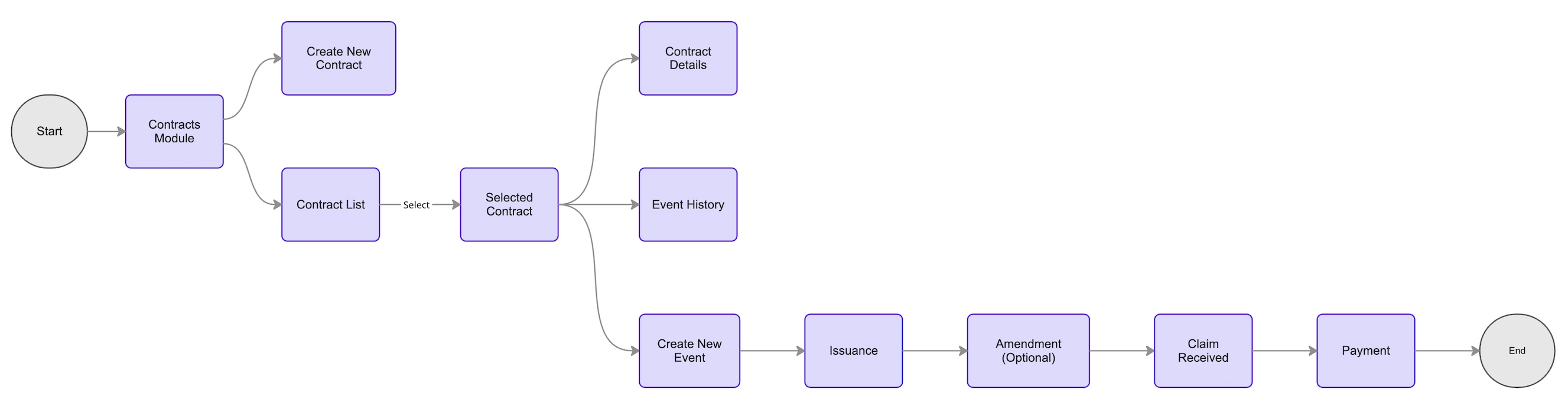

Restructuring the Logic

Before designing a single screen, I had to untangle the complex web of legacy dependencies. I mapped out the entire Import LC Lifecycle to identify redundant steps and create a linear path.

The Solution

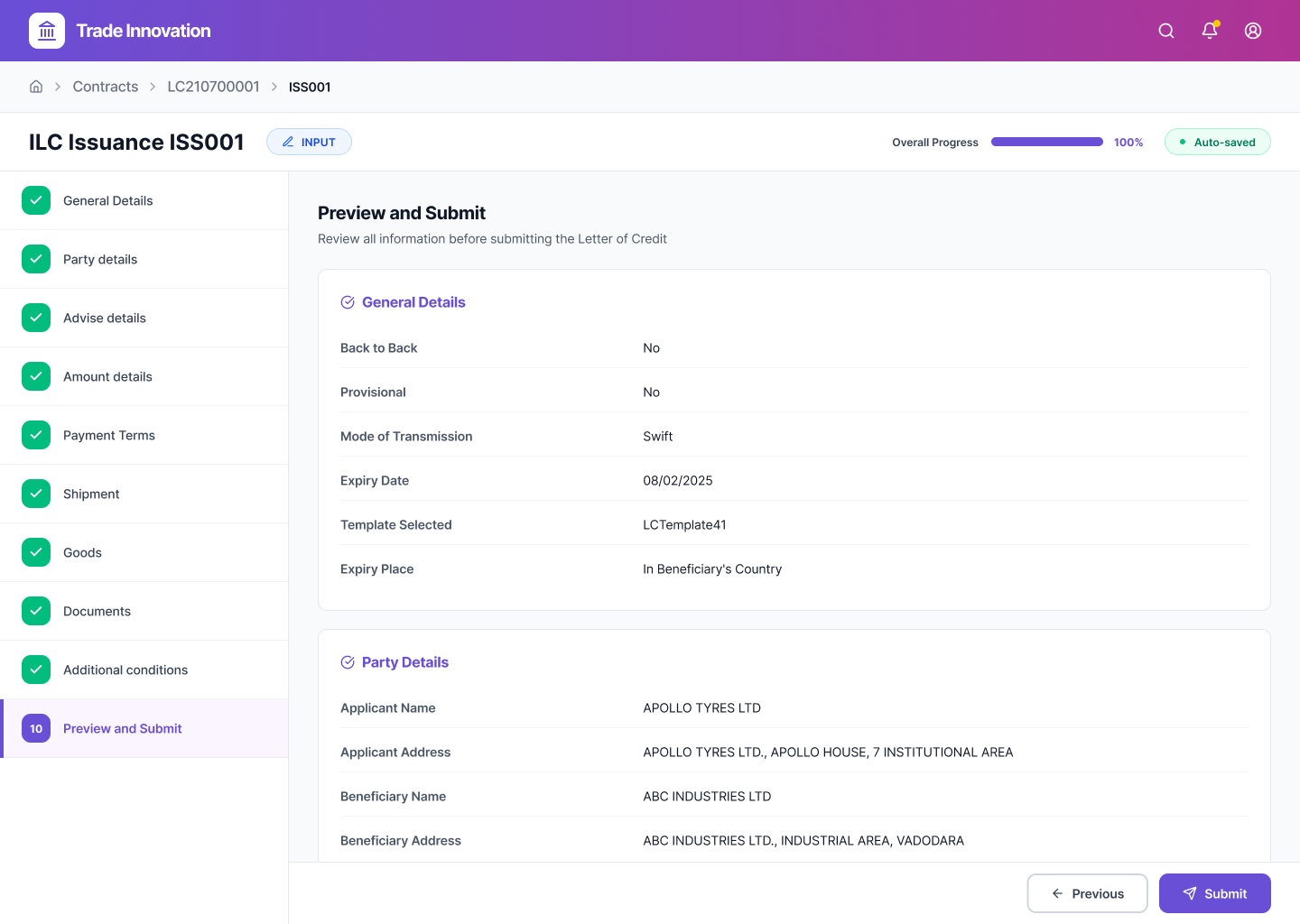

A. Guided Navigation

Progressive Stepper and Focused Form Design

I implemented a Progressive Stepper on the left rail to track completion. Complex sections like "Amount and Charges" were isolated into their own focused view.

B. Error Prevention (Defensive Design)

Real-Time Validation

In the legacy app, users often discovered errors only after attempting to save. I introduced Inline Validation that flags SWIFT compliance issues in real-time. This allows users to self-correct immediately without breaking their flow.

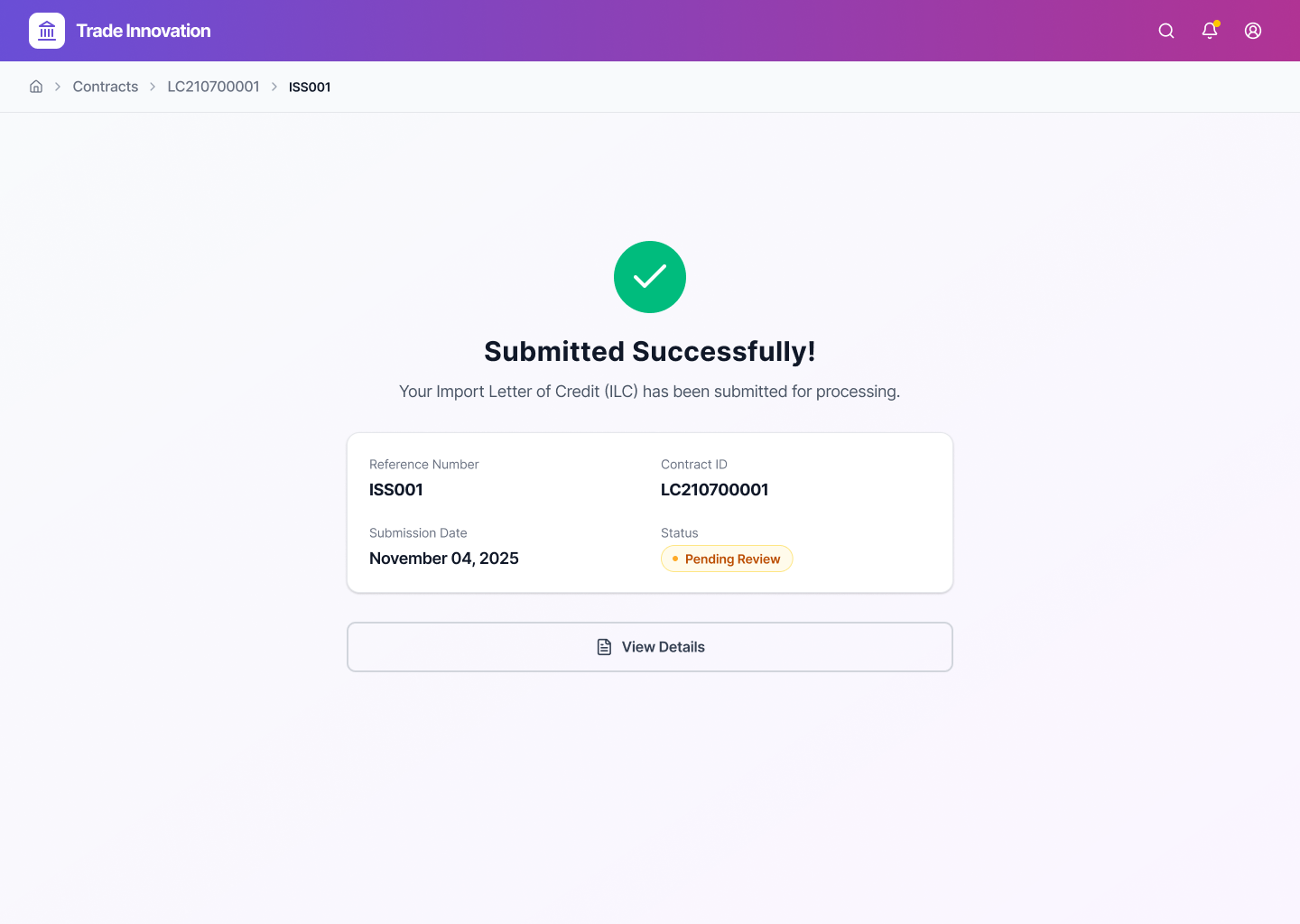

Closing the Loop

To ensure data integrity, I introduced a 'Review' summary screen before submission. This acts as a final gate, allowing the user to verify critical details like "Mode of Transmission" and "Expiry Dates" before committing the transaction.

System Feedback

Upon completion, the system provides a clear Success State, confirming the Transaction Reference Number and the next status (Pending Approval), ensuring the user knows exactly where their work went.